We will contribute to the realization of rational, convenient, and safe transactions by aiming to establish a Japanese version of escrow as a business category.

For example, in real estate transaction settlements, the safety and convenience of transaction administration is ensured by the real estate business operator’s collaboration with construction companies, financial institutions, specialists (judicial scriveners, land and building investigators, and other qualified professionals), and other parties through the division of labor.

The number of Internet-based impersonal transactions is expected to increase, and the operations of related businesses will increase due to the need to further strengthen compliance and other factors.

The situation will be time-consuming to ensure the safety, reasonableness, and convenience of traditional trade settlement methods alone.

Escrow means “third-party deposit. The escrow business was established in 1947 on the West Coast of the United States as a system to secure transactions in real estate transactions and money trusts of financial instruments by having a neutral third party handle the transaction, confirm performance, and settle the transaction. It has spread and grown throughout the United States as a specialized service that handles all procedures related to the settlement of real estate transactions.

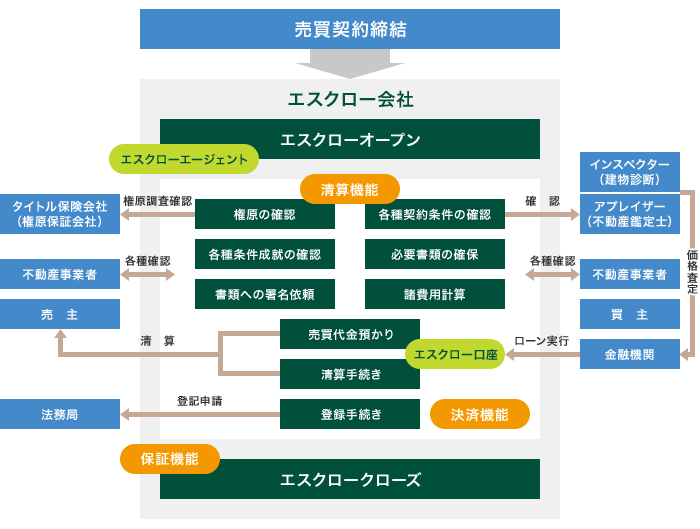

In the U.S., escrow companies serve as one-stop escrow companies that handle all procedures after the sales contract between the seller and buyer, including transaction administration, identification confirmation, confirmation of fulfillment of contract terms, and transaction settlement. In addition, a title insurance system (title insurance) is in widespread use, which guarantees the extent of the seller’s title to the property involved in the transaction settlement process.

Thus, in the U.S., escrow and title insurance systems are used as safe, reliable, and convenient services for consumers such as sellers and buyers, real estate businesses, and financial institutions.

Under the changing environment of all high value transactions, we are seeking a new distribution system based on the U.S. escrow and title insurance systems, and aim to create social value by simultaneously realizing cost reductions and safe transactions in escrow transactions.

The Company has established the “BPO business,” which consolidates transaction-related administrative work, and the “escrow service business,” which improves administrative efficiency as well as safety, rationality, and convenience.

We will enhance the settlement, settlement, and guarantee functions of transactions and realize transaction settlement security through a single package of operations.